Breaking the Last Barrier: The Case for a Universal “One Number Withdrawal” System in Tanzania

While you can send money across networks or pay bills easily, you must still find an agent tied to your network to withdraw cash. Agents juggle multiple floats; customers face unnecessary friction.

The Problem with Cash-Out TodayTanzania is one of Africa’s leaders in mobile money. Over 65 million accounts, billions of transactions annually, and nearly 1.5 million agents make it a success story in financial inclusion.

Yet, there’s a paradox.

- You can send money across networks,

- You can pay bills from any wallet,

- You can even transfer to banks seamlessly.

But when it comes to withdrawing cash, customers and agents are locked into silos:

- Customers must search for an agent of their network.

- Agents juggle multiple floats across networks and banks.

- Liquidity is fragmented, increasing costs and inefficiency.

This is the last big barrier to true financial interoperability.

Imagine if every agent in Tanzania had one unique number — a Universal Agent Number (UAN) — registered on the national switch.

- Customers could withdraw from any agent, regardless of their wallet or bank.

- Agents would only need one float account instead of four or five.

- The central switch would handle routing, settlement, and reconciliation.

In essence, it would work like Visa or Mastercard for cash-outs. You can use any ATM worldwide, pay a small fee, and the backend handles settlement.

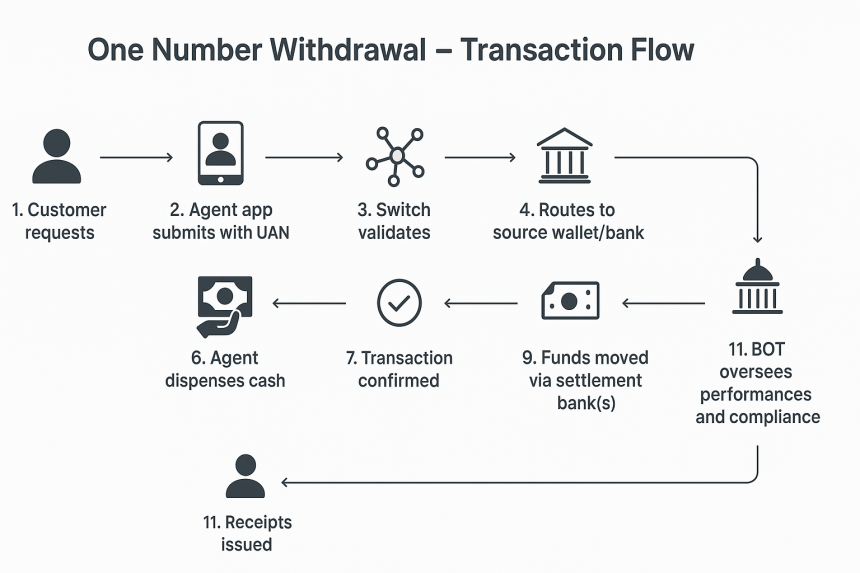

- Customer request: “Withdraw 50,000 TZS from any network to the agent.”

- Agent app submission: Agent uses UAN to enter the request.

- Switch validation: Ensures the agent is genuine, applies AML/KYC checks.

- Routing: The system forwards the request to the right wallet/bank.

- Authorization: Source wallet debits the customer account.

- Cash-out: Agent gives the cash.

- Confirmation: Transaction logged and receipts issued.

- Settlement: Central clearing balances net positions.

- Funds moved: Settlement banks transfer real money across providers.

- BOT oversight: Full visibility for regulation and compliance.

- No more running around to find “your” network’s agent.

- More access points in rural and underserved areas.

- Higher trust and convenience.

- One number, one float, one app.

- Reduced operational costs (no multiple phones/terminals).

- Easier liquidity management.

- Lower onboarding costs for agents.

- New revenue streams via off-net withdrawal fees.

- Improved customer satisfaction and retention.

- Clearer oversight of transactions.

- Better tools to enforce AML/CFT rules.

- Pushes Tanzania further into national digital payments integration.

- Settlement risk: Requires robust clearing and real-time reconciliation.

- Fee model: Needs a fair structure (like ATM withdrawal fees).

- Technical integration: Each provider must connect to the central switch.

- Liquidity management: Settlement banks must guarantee funds.

- Change management: Agents and customers need education on the new system.

- Mobile money already touches 80%+ of Tanzanians.

- Over TZS 198 trillion moved through wallets in 2024.

- Agents are nearing 1.5 million, but fragmentation limits efficiency.

- BOT has already built TIPS (Tanzania Instant Payment System) — the foundation is there.

A Universal Withdrawal System would be the logical next step in Tanzania’s journey toward financial inclusion and digital transformation.

- Regional expansion: UAN could be extended to East African Community (EAC) markets.

- Banking integration: Customers could withdraw from banks and wallets interchangeably.

- Blockchain & Smart Contracts: Future settlement could be automated for transparency and speed.

- Data-driven innovation: With a central switch, providers and regulators can leverage transaction data for new financial products.

Tanzania has already led Africa in mobile money adoption. The next big leap is to remove the last barrier — cash-out fragmentation.

A One Number Withdrawal System would:

- Simplify life for customers,

- Empower agents,

- Create efficiency for providers, and

- Strengthen regulatory oversight.

Just as Visa made global ATM access universal, Tanzania can lead Africa in universal mobile money withdrawals — proving once again that innovation here can inspire the world.

Revolutionizing Audit Exception Management: Why Automation is the Futu...

Managing audit exceptions has always been a challenge for organizations. Whether the excep...

Demystifying Tanzania's Control Number System: The Digital Payment Bac...

Ever paid for a business license, a university fee, or a utility bill in Tanzania? If you'...