The Future of Banking in Tanzania: Why Digital Onboarding is No Longer Optional

Over the past decade, Tanzania has experienced an incredible transformation in financial services — yet, a critical gap remains.

The Reality Today- Over 60 million mobile money accounts exist in Tanzania, powering day-to-day transactions.

- Bank account ownership is still low — only about 54% of Tanzanians are financially included.

- Internet penetration sits at 29.1%, meaning millions are online but not connected to formal banking systems.

This mismatch highlights a core challenge: accessibility.

Many potential customers want to open bank accounts, but are blocked by:

- Long distances to the nearest branch.

- Endless queues.

- Slow manual registration processes.

- Limited digital banking services.

With over 3 years of fintech experience and 11 months working inside banking, I’ve seen firsthand how manual processes not only slow down banks but also discourage customers.

In the next 5 years, it will be inevitable for banks to operate without automation. The Bank of Tanzania (BOT) has already emphasized that digital banking is not just an option but a regulatory and operational priority.

We’ve built a digital on-boarding prototype designed to break these barriers:

- Seamless User Journey:

- From entering NIN to bio-metric checks (face/fingerprint), digital signatures, and OTP confirmation.

- Account Type & Tariff Transparency:

- Users can view account options, tariffs, and requirements upfront.

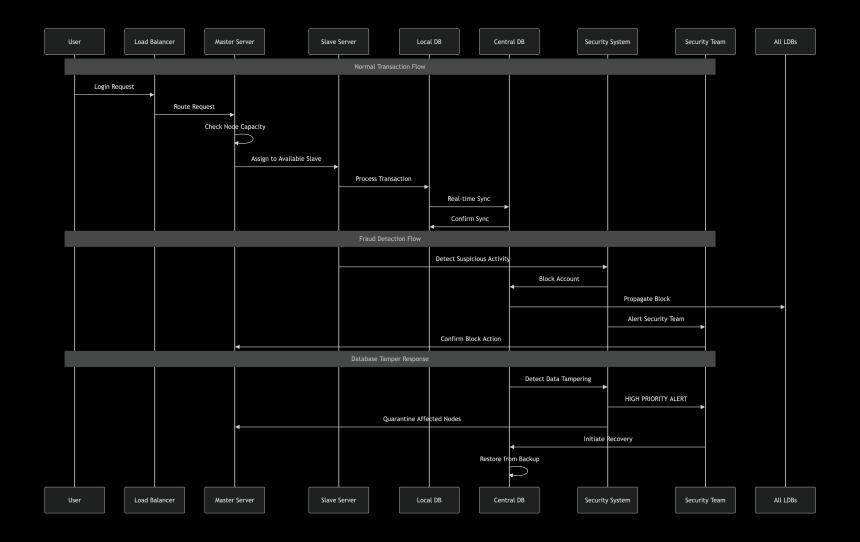

- Real-Time Tracking:

- Customers can track their application status and download mandate forms with a bank’s stamp.

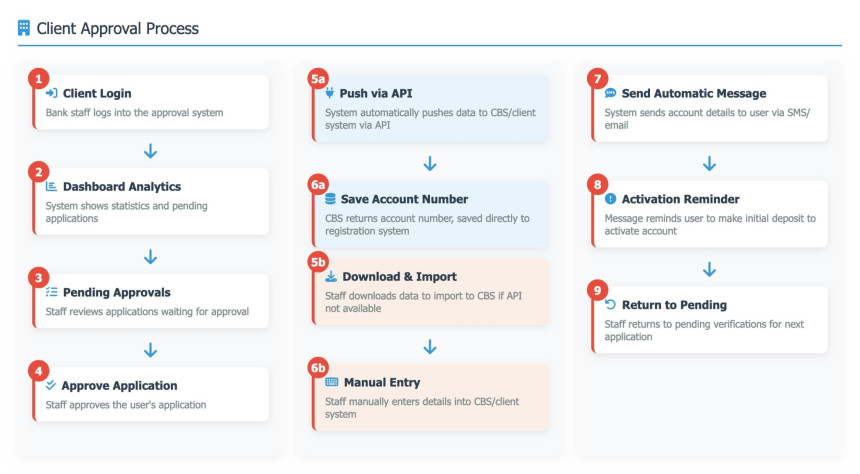

- Client-Side Efficiency:

- Banks can approve applications quickly, push directly to their CBS, or export details for manual entry.

- Cost Reduction:

- By minimizing reliance on POS machines and manual paperwork, banks significantly cut operational costs.

- Faster on-boarding and customer acquisition.

- Reduced operational costs.

- Improved compliance and reporting.

- Enhanced financial inclusion — reaching the unbaked population.

This isn’t just about tech. It’s about inclusion. Every Tanzanian who wants a bank account should have the opportunity to open one without barriers.

If you are a bank or financial institution looking to digitize and simplify your on-boarding processes, let’s connect.

This system is available free for piloting, and we can work with you to extend, configure, and integrate it directly with your CBS.

There is something powerful about water.

When you walk a long distance to fetch it, you learn to value every single drop. You don’t...