Banking & Finance Fraud Mitigation Strategies: Building a Secure Financial Future

Fraud in the banking and financial sector is one of the most pressing challenges in today’s digital economy.

From phishing attacks and identity theft to sophisticated cybercrimes and internal fraud, financial institutions face constant threats that can erode customer trust and lead to huge financial losses. To stay ahead, banks must adopt robust fraud mitigation strategies that combine technology, compliance, and human vigilance.

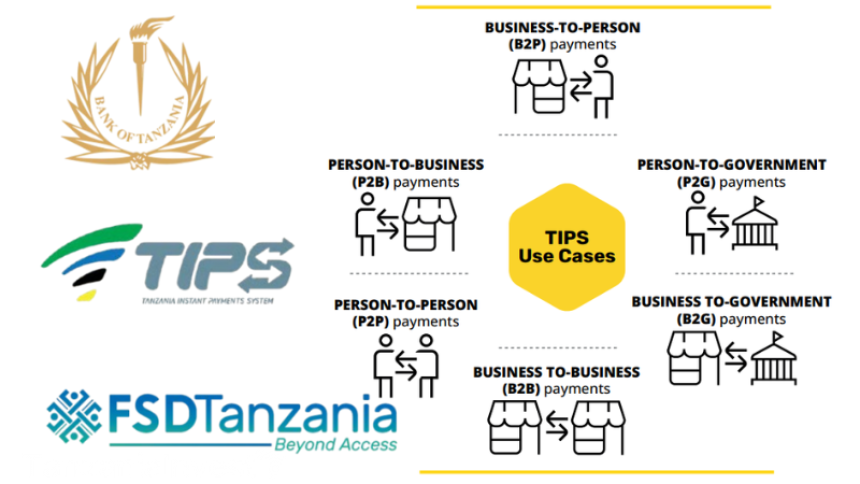

According to global financial crime reports, billions of dollars are lost annually to fraud schemes. In Africa and other emerging markets, the rise of mobile banking, digital wallets, and instant payments has opened new opportunities for criminals. For financial institutions, effective fraud prevention is not just about compliance—it’s about protecting customers, safeguarding brand reputation, and maintaining operational stability.

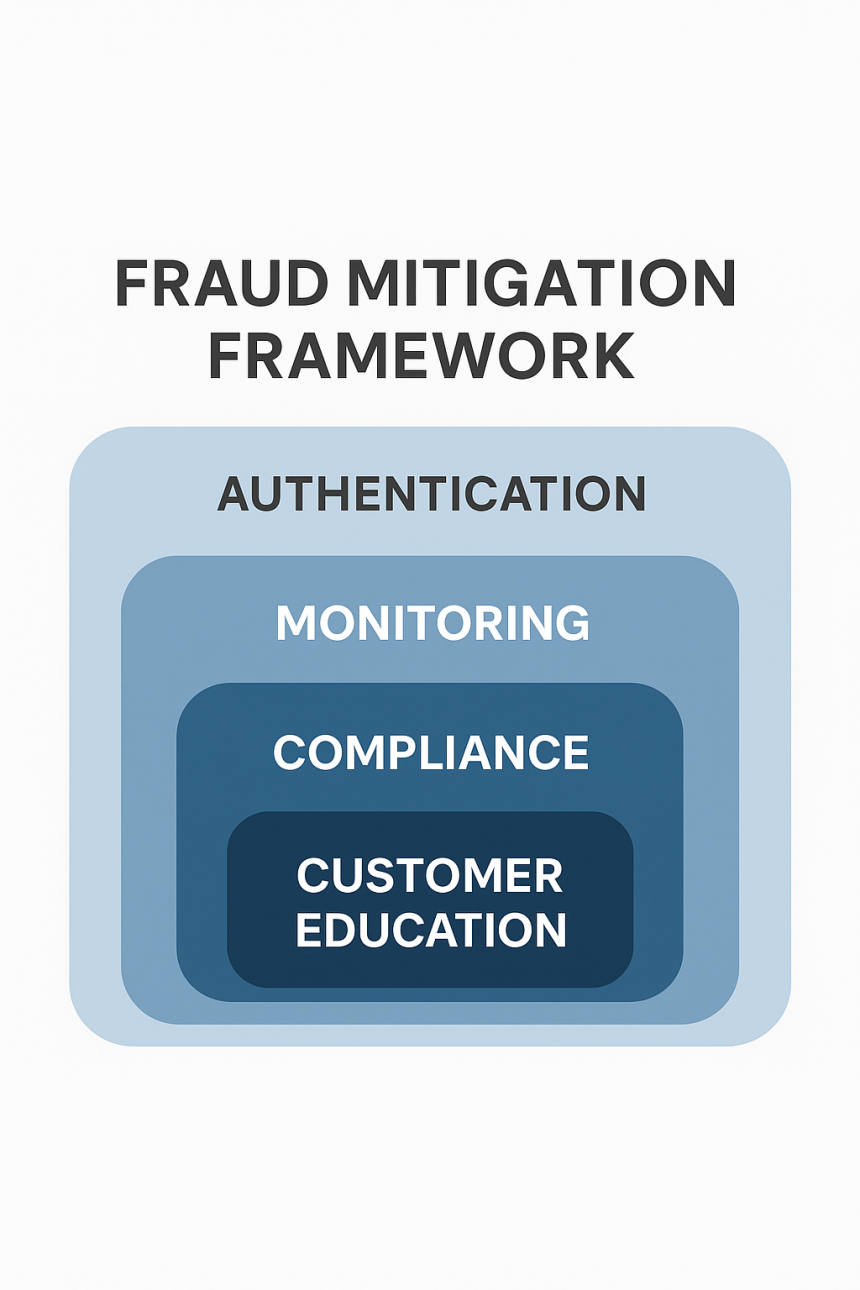

Implement two-factor or multi-factor authentication (MFA) for all digital banking channels. Combine biometrics (fingerprints, facial recognition) with OTP-based verification to reduce account takeover risks.

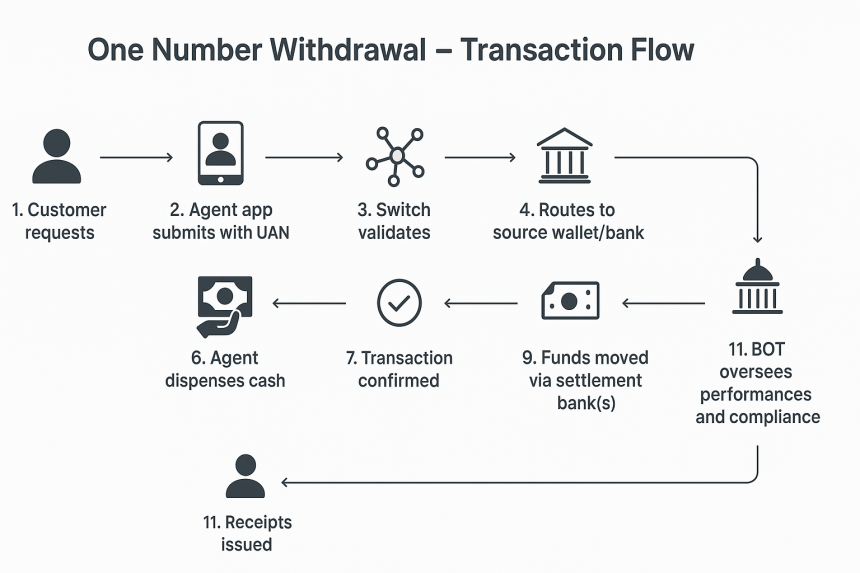

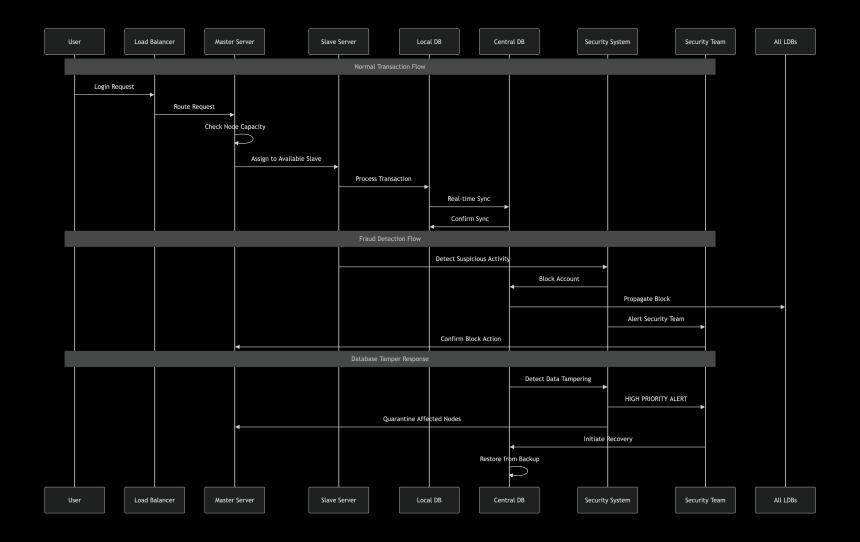

2. Real-Time Transaction MonitoringBanks should deploy AI-driven fraud detection systems that monitor transactions in real time. These systems use machine learning to detect suspicious patterns such as:

- Unusual login locations

- High-value transactions outside normal behavior

- Rapid consecutive withdrawals

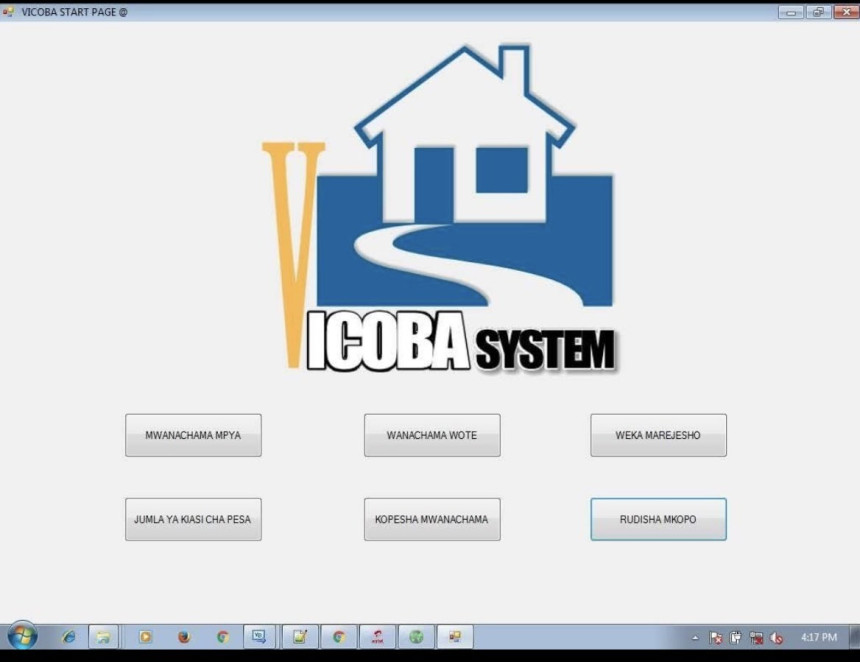

Robust KYC/KYB frameworks ensure that every account holder and business client is verified during onboarding. This includes:

- Document verification (IDs, passports, business licenses)

- Screening against sanctions and PEP (Politically Exposed Persons) lists

- Periodic KYC reviews

A large percentage of financial fraud involves internal staff collusion. Mitigation measures include:

- Role-based access control to limit sensitive data access

- Segregation of duties

- Continuous employee training on fraud red flags

End-to-end data encryption, secure APIs, and regular penetration testing are critical to prevent cyber-attacks targeting banking systems.

6. Strong Customer EducationEducate customers about common scams such as:

- Phishing emails and fake banking websites

- SIM swap fraud

- Social engineering tactics

- Regular awareness campaigns reduce the likelihood of customer-driven breaches.

Compliance with standards like:

- PCI DSS for payment security

- AML (Anti-Money Laundering) & CFT (Countering the Financing of Terrorism) regulations

- Central Bank and Basel Committee guidelines

- ensures legal alignment and strengthens fraud prevention.

Emerging technologies are transforming fraud prevention:

- AI & Machine Learning: Predict and flag anomalies in real-time

- Blockchain: Enhances transparency in transactions

- Behavioral Biometrics: Detects suspicious user patterns

- RegTech Solutions: Automates compliance monitoring

Fraud mitigation in banking and finance is not a one-time project—it’s a continuous process that evolves with new threats. A combination of technology, compliance, and customer awareness creates the strongest defense. Banks that invest in these strategies will not only protect themselves but also build trust and long-term customer loyalty.

Want to strengthen your financial institution’s fraud prevention strategy? Adopt AI-powered fraud detection, invest in staff training, and educate your customers today—before fraud hits your bottom line.

Revolutionizing Audit Exception Management: Why Automation is the Futu...

Managing audit exceptions has always been a challenge for organizations. Whether the excep...