Why Automation Matters in Banking — A Tanzania Case

Across Tanzania’s banking sector, automation isn’t just an I.T. upgrade — it’s a business strategy. From onboarding to payments and risk, the banks winning today are the ones turning manual, paper-heavy processes into reliable, data-driven workflows.

A quick case vignette (Tanzania context):

A mid-size bank mapped three friction points: customer onboarding, loan processing, and reconciliation.

By automating KYC with OCR + rules, digitizing credit workflows, and reconciling mobile money/TIPS transactions in near-real time, they achieved:

Faster time-to-yes:

account & loan approvals in hours, not days

Lower cost-to-serve: fewer manual touchpoints, fewer errors

Better compliance: auditable trails for KYC/AML, real-time alerts

Happier customers: consistent service across branch, agent, USSD, app

Why this matters for business leaders:

Revenue growth: Straight-through processing lets you launch and scale products (SME loans, micro-savings, merchant acquiring) without linear staff growth.

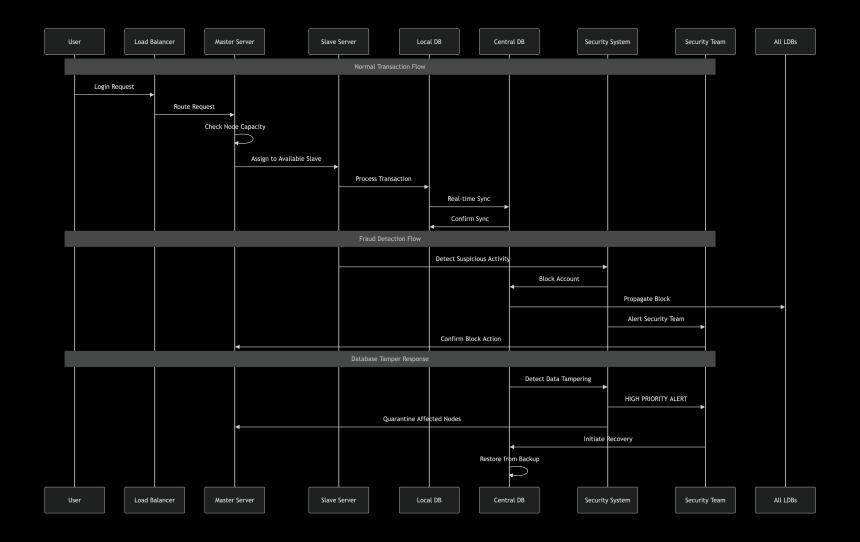

Risk control:

Automated checks flag anomalies early — think duplicate IDs, cash-flow mismatches, or unusual agent activity.

Operational resilience: Bots don’t sleep; cutoffs and reconciliations run reliably, improving availability for peak periods (salary days, school fees, tax deadlines).

Data advantage: Clean, structured data from automated journeys feeds pricing, collections, and cross-sell models.

Customer experience: Instant onboarding + real-time payments (incl. TIPS rails) set the benchmark. If it isn’t instant, it feels broken.

Where to start (practical playbook):

Pick high-ROI journeys: onboarding, loan origination, collections, & daily reconciliation.

Automate the decision points, not just the screens: codify policies (KYC, affordability, exceptions).

Integrate channels and rails: branches, agents, USSD, app, cards, mobile money, and TIPS.

Design for audit & risk: logs, versioned rules, maker–checker, and alerts from day one.

Measure relentlessly: TAT, abandonment, STP rate, cost-to-income, NPL leading indicators.

Tanzania edge:

Our unique mix of mobile money usage, agent banking, and shared payment infrastructure makes automation pay back quickly. Banks that industrialize these flows will outpace on speed, cost, and trust.

Kwa kifupi:

Ukiboresha michakato kwa “automation”, unashusha gharama, unaongeza kasi ya huduma, na unalinda hatari — matokeo yake ni wateja kurudi na biashara kukua.

If you’re exploring this in your institution, I’m happy to share templates (process maps, KPI dashboards, and vendor checklists).

Let’s connect.

There is something powerful about water.

When you walk a long distance to fetch it, you learn to value every single drop. You don’t...